Convenient payment solution made simple

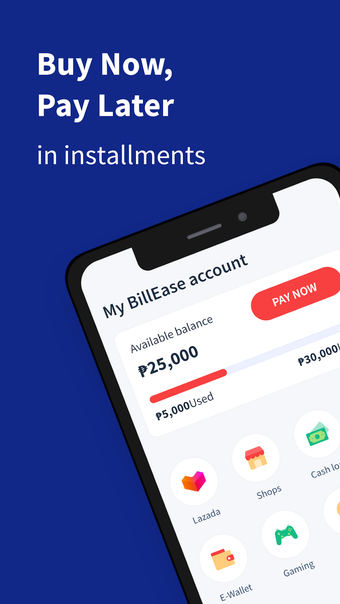

BillEase Buy Now Pay Later is a free financial app for Filipinos, allowing them to purchase items instantly and spread the cost over time with easy monthly payments. It's designed for those who prefer financial flexibility while shopping, helping users manage their budgets without the stress of lump-sum payments.

Top Recommended Alternative

Comparing it to Atome, which also caters to the Philippine market, both offer similar convenience, but BillEase Buy Now Pay Later provides more localized options. This makes the app an attractive choice for tech-savvy and budget-conscious shoppers looking to balance their finances seamlessly.

Flexible payment options for smart spending

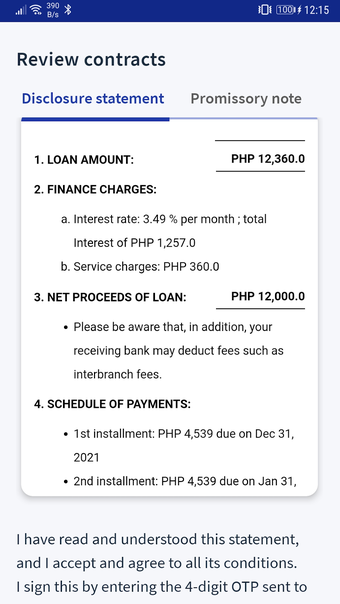

BillEase Buy Now Pay Later allows users to spread payments over manageable terms, offering installment plans of three, six, nine, or 12 months. This enables users to purchase essentials or luxuries without financial strain. Its no-credit-card-required policy makes it accessible to a wider audience, including first-time borrowers. The app ensures affordability with low interest rates and even offers zero-interest options for select merchants, making financial management easier and more predictable.

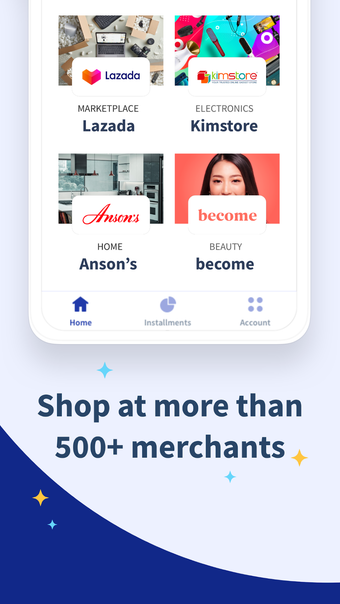

With its quick and seamless approval process users can set up an account in minutes with minimal requirements, making it accessible to more users. Once approved, they can use their credit limit across multiple partner stores and services. With over 4,000 partner merchants, users can enjoy installment plans for groceries, gadgets, or even travel bookings, all managed directly from the app.

For added convenience, the app offers multiple repayment methods, including e-wallets, online banking, and over-the-counter channels. It also sends timely reminders to ensure users stay on top of their dues and avoid penalties. However, it’s important to note that the app is primarily focused on local merchants, limiting its usability for international transactions. This makes it ideal for domestic shopping but less suited for global spending needs.

A practical choice for everyday budgeting

Ultimately, BillEase Buy Now Pay Later strikes a balance between convenience and financial responsibility, making it a go-to app for manageable payments. Its quick setup, diverse partner network, and flexible terms cater to various shopping needs. While it’s an excellent option for local purchases, its limitation with foreign merchants could be a drawback for some users. Evaluate its compatibility with your needs to make the most of its benefits.